Financial Review: CBA gives business clients tool to measure building energy efficiency

The launch of our Green Buildings Tool was recently covered in the Australian Financial Review: “Commonwealth Bank, the country’s biggest commercial real estate lender, is rolling out an online tool for mid-market landlord customers to calculate the environmental efficiency of their property and estimate the cost of upgrading their assets.”

The bank, which has an $83 billion commercial property loan book, has partnered with Dutch consultancy CFP Green Buildings to make available the platform using data including location, age of building, use type and net lettable area to customers without the ability to make such measurements themselves.

Scalability

“The scalability of this tool is really quite large,” CBA’s general manager of property and construction finance Michael Bennett told The Australian Financial Review. “We can bring this down to a corner shop. They can see what their building is doing, and what they may need to do to enhance the sustainability of that asset. And we can also take it up to a large 15,000-20,000-square-metre office building as well.”

Avoid stranded assets

Owners of assets from offices through to retail and aged care are under pressure from rising energy costs for more energy-efficient buildings, but also to support tenant demands to fulfil obligations such as net-zero operational carbon emissions by 2030 as the dangers of climate change become clearer.

Buildings typically emit 600kg to 1000kg of CO2 per square metre over a notional 60-year life span, with roughly half of that from embodied carbon and half from operational carbon, data from consultancy Arup shows. Banks also need to avoid being stuck with assets that shed value in a changing market. “The concern for any lender would be the concept of a stranded asset – an asset that capital doesn’t want to acquire because of its lack of credentials, that debt doesn’t want to lend to because of his lack of credentials,” Mr Bennett said.

Business opportunity

It’s also a business opportunity. Across a business bank commercial real estate loan book of $55 billion, CBA’s customers own a collective $130 billion worth of assets, of which 30 per cent is retail, 26 per cent office and up to 16 per cent industrial. “We obviously have the ability to fund the retrofitting of these buildings,” said CBA’s group executive for business banking Mike Vacy-Lyle. The business bank has 1.3 million clients, of which “a couple of hundred thousand” – both landlords and tenants – would be able to use the tool, Mr Vacy-Lyle said.

Green Buildings Tool

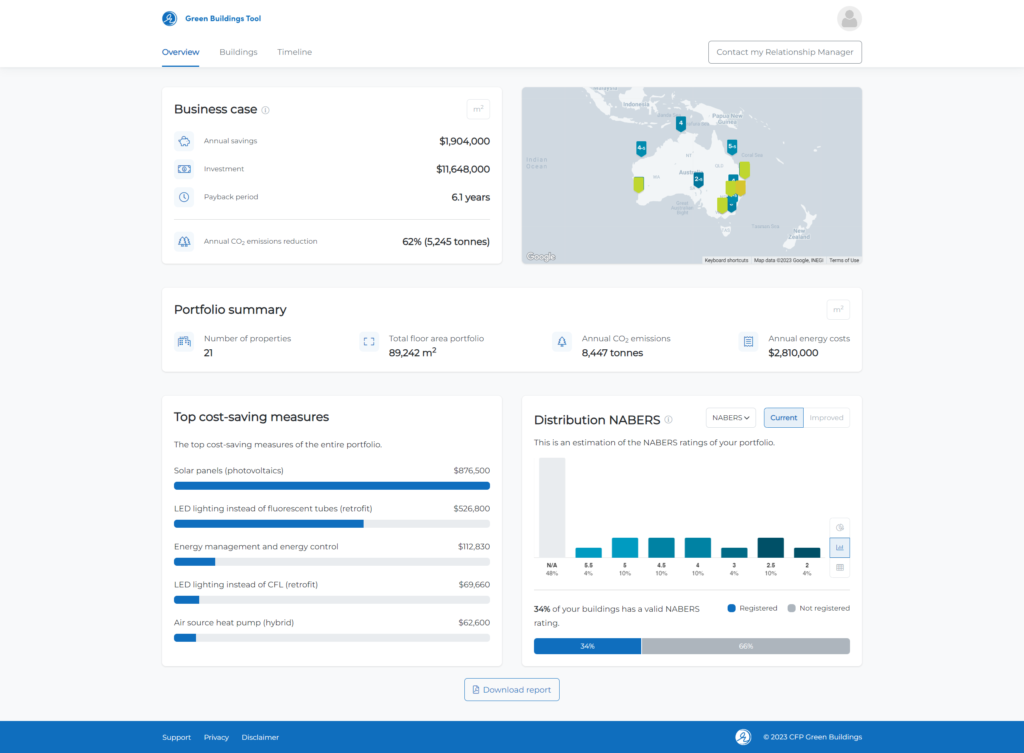

The Green Buildings Tool allows owners to estimate their buildings’ baseline emissions footprint, the impact of property upgrades on energy use and emissions, the cost of upgrades and potential cost savings. Owners of buildings with NABERS ratings can use it to estimate the effect of higher ratings. The tool does not currently include Green Star ratings, but that will be implemented in the future, CBA said. CBA is the first bank in Australia to introduce the platform, already used by Europe-based banks including Rabobank, Lloyds, HSBC and ING.

In Europe, where environmental legislation is stricter, banks including Lloyds and ING use the tool to estimate the baseline emissions of an asset when originating commercial real estate loans, but in Australia the same rules do not apply and it was not CBA’s policy, Mr Bennett said.

Banks also had to use their data capability – such as the ability to measure building’s performance – to provide services that would keep customers. This was particularly the case in the mid-tier business banking market into which fintech start-ups had managed to carve out space for themselves, Mr Vacy-Lyle said. “The whole fintech model is go to areas where there is customer friction, poor customer experiences and big profit pools,” he said. “So fintech is drawn to business banking because there’s friction, customer experience, bad customer experience, because banks haven’t invested. And there’s a massive profit pool there. “So it’s basically a war or a race at the moment as to who can differentiate the customer experience in business banking.”

Futureproof your real estate

If you would like to know more about our Green Buildings Tool, feel free to reach out for a free demo. We are happy to share thoughts and see how we can help your business.